Women Business Loans

Women Business Loans

CASHTREE Finance provides 2% special discount on interest to Women Entrepreneurs without Property Collateral.

You may know that women entrepreneurship has been declined in India in the last decade. Less than 14% of all businesses in India are owned by women. Empowering women entrepreneurs leads to financial Independence and brings new jobs to communities. Thus, we are committed to do our part to enabling self-employments in India.

Loan Requirements

- Loan amount up to 2 lakhs

- Loan Tenor up to 24 months

- No ITR required

- Continuity in same line of business of 2 years

- No Collateral Required

- Attractive Rate of Interest in industry

- Ownership of Home or Business, any one is mandatory

- PAN Card

- Driving License

- Passport

- Voter's ID

- Aadhaar Card

- Passport

- Driving License

- Voter's ID

- Aadhaar Card

- Utility Bill

- Bank Statement/Bank Account Passbook (Updated and no more than 3 months old)

- Registered / Notarized Rent Agreement

- Utility Bills (electricity / water / telephone / internet / piped gas)

- Current / CC / OD Bank account

- Property sale deed

- Registered / Notarized Rent Agreement

- GST registration / provisional certificate

- VAT (permissible only for applications from petroleum industry)

- Registration under Central Excise and Customs

- Professional Tax registration certificate

- IEC (Import Export Certificate)

- Shop & Establishment Act registration / New Maharashtra Shop & Establishment Act registration

- Registration Certificate under Labour Department

- Agricultural Board Trade Licence

- Registration under Legal Metrology Act

- Food and drugs control certificate / Drugs Licence

- Rail E-Ticketing Centre Certificate

- Factory License

- Central / State Govt. Contractor License

- SEBI Registration Certificate

- Trade Mark Registration Certificate

- Cable Operator Registration Certificate

- Clinical Establishment Certificate

- Establishment of a Motor Driving School (FORM-11)

- Registration Certificate issued by Municipal Corporation / Mahanagar Palika / Nagar Panchayat / Gram Panchayat

- District Industries Centre EM Part II

- Registration of Firm under Partnership Act (applicable for partnerships firms)

- Audited Financials /ITR (applicable for proprietorship)

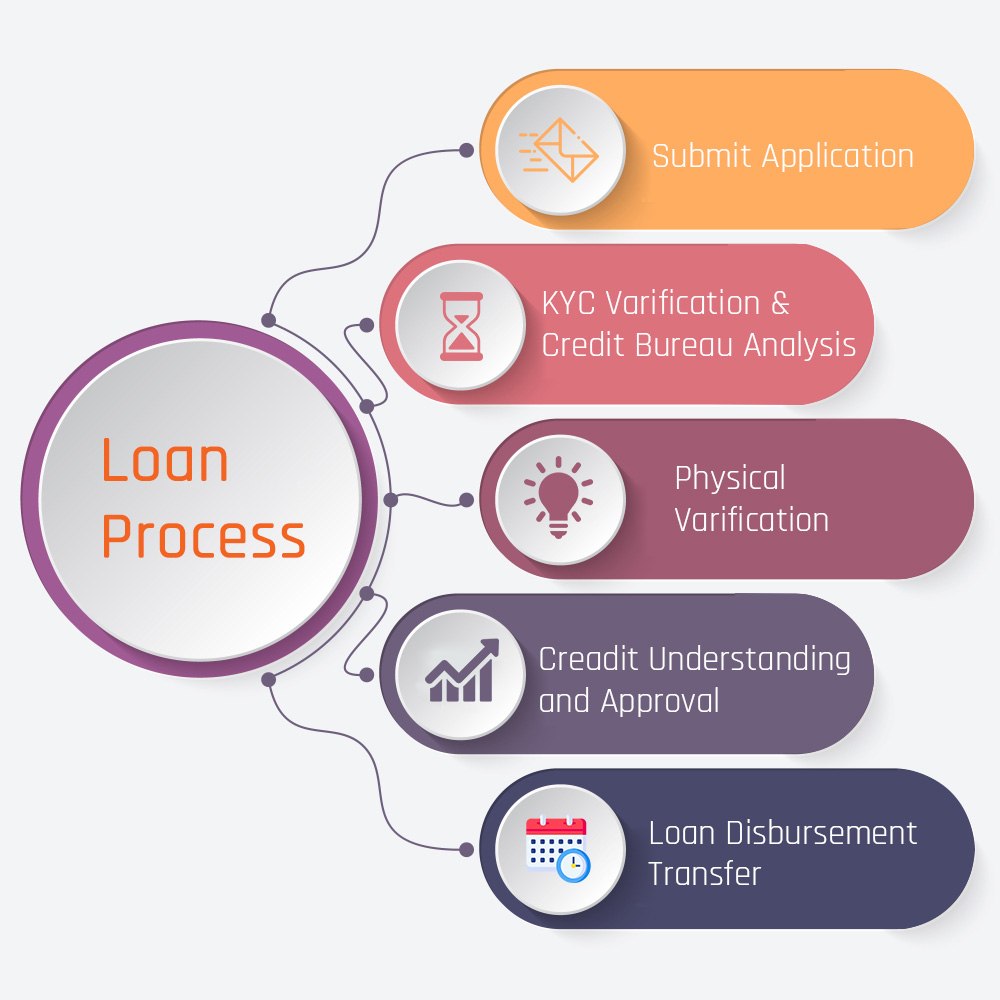

Simple steps to your MSME / SME Loans

This is not an exhaustive list, but the financial services industry encompasses companies in one or more of the following lines of business:

- Submit Application

- Simply enter your personal, business and financial

- Upload Documents

- Upload digital copies of your documents in a single step process for verification.

- Get Sanctioned

- Receive your MSME / SME Loans approval and disbursal within 3 working days.