Business Loan

Business Loan

CASHTREE Finance Private Limited endeavours to transform small businesses with an objective to provide growth capital to self-employed micro and small enterprises in India with innovative products and services blended with local expertise while ensuring seamless and personalised delivery in a highly technology enabled environment.

These products will deliver convenient and affordable access to credit to self-employed entrepreneurs and micro enterprises who are by and large excluded from the formal financial sector either directly or indirectly.

Loan Requirements

- Loan amount up to 2 lakhs

- Loan Tenor up to 24 months

- No ITR required

- Continuity in same line of business of 2 years

- No Collateral Required

- Attractive Rate of Interest in industry

- Ownership of Home or Business, any one is mandatory

- PAN Card & Aadhar Card

- Continuity in business-Min. 2 years in the same line of business

- Residence stability for 3 years

- Business/Shop/Office stability for 2 years

- Financial documents –Last 6 months bank statements. If you don’t have ITR then our team will support you for alternatives documentation

- In case of Seasonal/Festival requirement they can avail up to 50% of Primary loan amount.

- Short seasonal tenure 6 months to 1 year

- Attractive rate of Interest

- Existing loan customers with a good repayment track record can apply after 6 months of taking their primary loan

- Secured against the existing assets under the primary loan

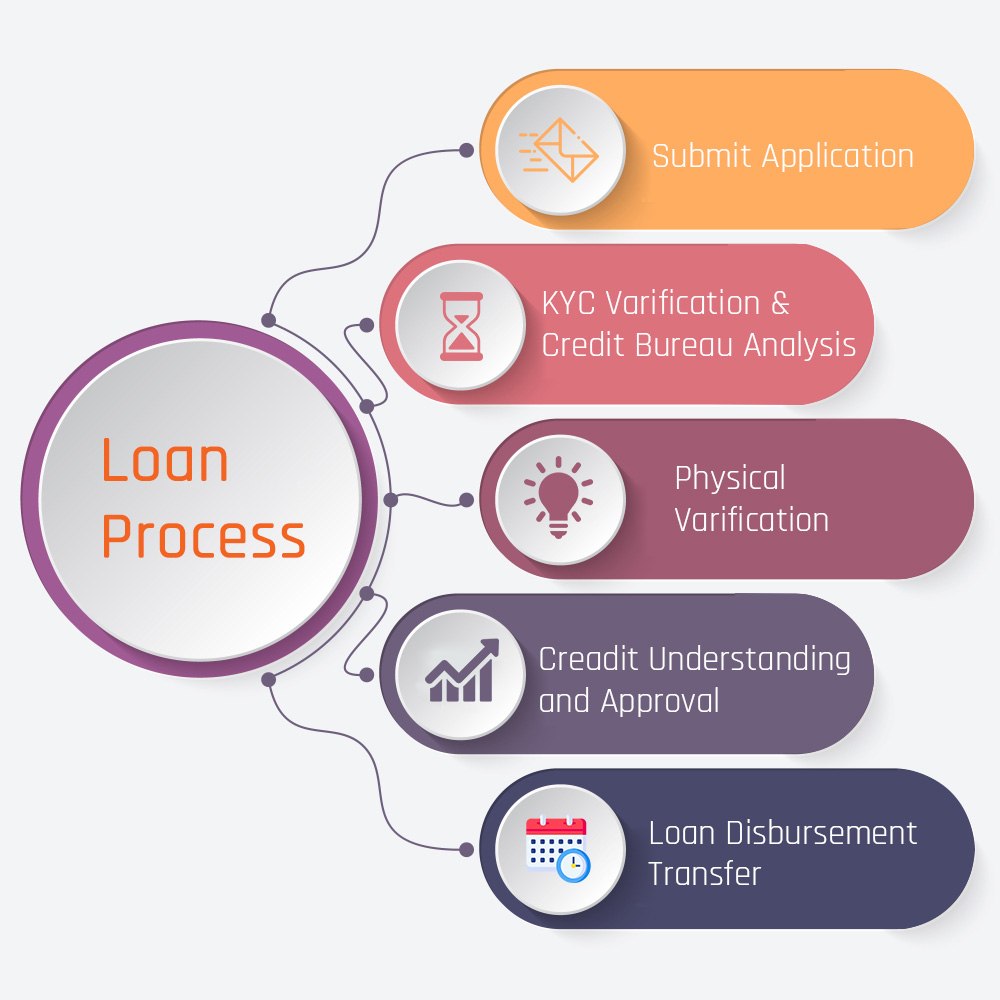

Simple steps to your MSME / SME Loans

This is not an exhaustive list, but the financial services industry encompasses companies in one or more of the following lines of business:

- Submit Application

- Simply enter your personal, business and financial

- Upload Documents

- Upload digital copies of your documents in a single step process for verification.

- Get Sanctioned

- Receive your MSME / SME Loans approval and disbursal within 3 working days.