Loan Against Property (LAP) Secured

Loan Against Property (LAP) Secured

Loan Requirements

- Loan amount up to 2 lakhs

- Loan Tenor up to 24 months

- No ITR required

- Continuity in same line of business of 2 years

- No Collateral Required

- Attractive Rate of Interest in industry

- Ownership of Home or Business, any one is mandatory

- PAN Card

- Driving License

- Passport

- Voter's ID

- Aadhaar Card

- Passport

- Driving License

- Voter's ID

- Aadhaar Card

- Utility Bill

- Bank Statement/Bank Account Passbook (Updated and no more than 3 months old)

- Registered / Notarized Rent Agreement

- Utility Bills (electricity / water / telephone / internet / piped gas)

- Current / CC / OD Bank account

- Property sale deed

- Registered / Notarized Rent Agreement

- GST registration / provisional certificate

- VAT (permissible only for applications from petroleum industry)

- Registration under Central Excise and Customs

- Professional Tax registration certificate

- IEC (Import Export Certificate)

- Shop & Establishment Act registration / New Maharashtra Shop & Establishment Act registration

- Registration Certificate under Labour Department

- Agricultural Board Trade Licence

- Registration under Legal Metrology Act

- Food and drugs control certificate / Drugs Licence

- Rail E-Ticketing Centre Certificate

- Factory License

- Central / State Govt. Contractor License

- SEBI Registration Certificate

- Trade Mark Registration Certificate

- Cable Operator Registration Certificate

- Clinical Establishment Certificate

- Establishment of a Motor Driving School (FORM-11)

- Registration Certificate issued by Municipal Corporation / Mahanagar Palika / Nagar Panchayat / Gram Panchayat

- District Industries Centre EM Part II

- Registration of Firm under Partnership Act (applicable for partnerships firms)

- Audited Financials /ITR (applicable for proprietorship)

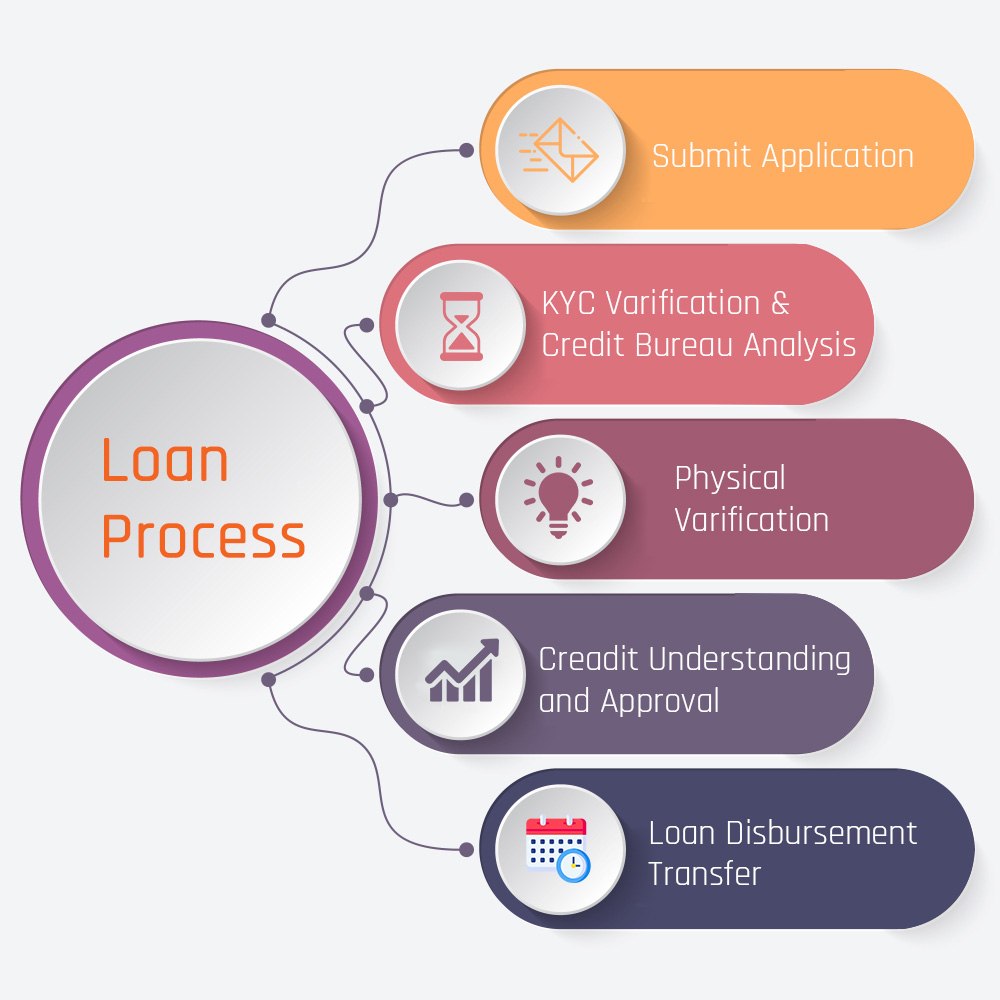

Simple steps to your MSME / SME Loans

This is not an exhaustive list, but the financial services industry encompasses companies in one or more of the following lines of business:

- Submit Application

- Simply enter your personal, business and financial

- Upload Documents

- Upload digital copies of your documents in a single step process for verification.

- Get Sanctioned

- Receive your MSME / SME Loans approval and disbursal within 3 working days.