MSMEs Loan

MSMEs Loan

MSMEs loans are for small and medium enterprises, who are engaged in manufacturing, trading or services business and looking for funding to expand their existing business. At CASHTREE Finance, we are committed to aid businesses with adequate loans for their business expansion, purchase of machinery and other business needs

Loan Requirements

- Loan amount up to 2 lakhs

- Loan Tenor up to 24 months

- No ITR required

- Continuity in same line of business of 2 years

- No Collateral Required

- Attractive Rate of Interest in industry

- Ownership of Home or Business, any one is mandatory

- PAN Card & Aadhar Card

- Continuity in business-Min. 2 years in the same line of business

- Residence stability for 3 years

- Business/Shop/Office stability for 2 years

- Financial documents –Last 6 months bank statements. If you don’t have ITR then our team will support you for alternatives documentation

- In case of Seasonal/Festival requirement they can avail up to 50% of Primary loan amount.

- Short seasonal tenure 6 months to 1 year

- Attractive rate of Interest

- Existing loan customers with a good repayment track record can apply after 6 months of taking their primary loan

- Secured against the existing assets under the primary loan

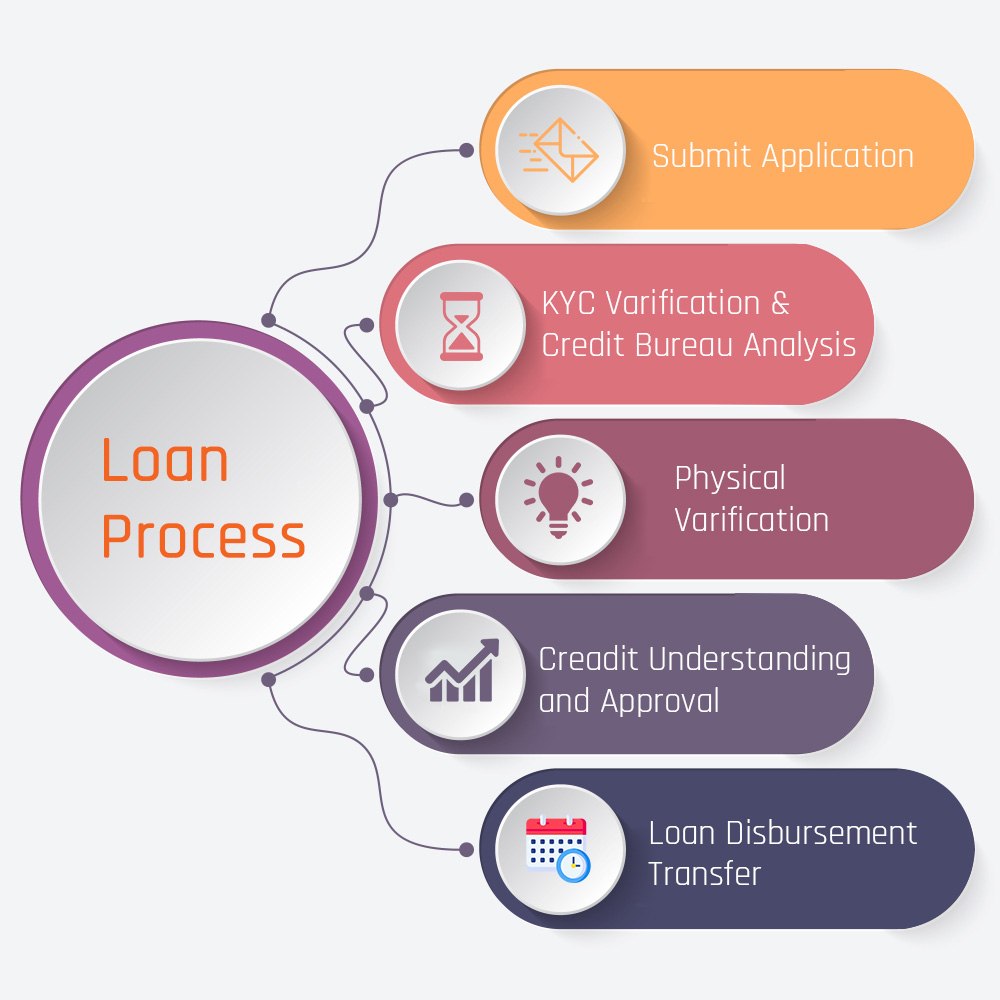

Simple steps to your MSME / SME Loans

This is not an exhaustive list, but the financial services industry encompasses companies in one or more of the following lines of business:

- Submit Application

- Simply enter your personal, business and financial

- Upload Documents

- Upload digital copies of your documents in a single step process for verification.

- Get Sanctioned

- Receive your MSME / SME Loans approval and disbursal within 3 working days.